Have you ever wondered how much money you need to buy a home?

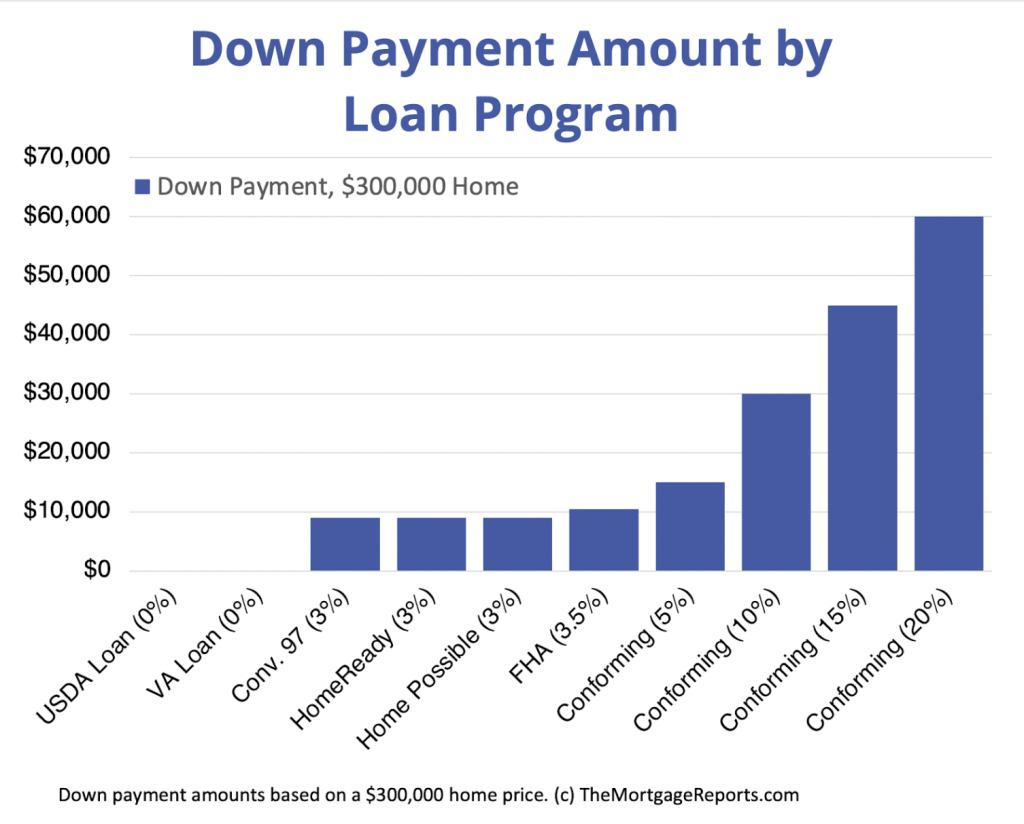

When it comes to getting a mortgage, there are a few things to know. First off, each type of mortgage has its own minimum down payment requirement, and we’ve got the details for you below. But here’s some good news – there are two loans, USDA and VA, where you don’t need to worry about a down payment. Just keep in mind that VA loans are for those with military service, and USDA loans are typically for folks in rural areas.

Now, let’s talk numbers. Down payment requirements can vary from 3% to 20%, and you can always choose to put down more if you can. To break it down further, if you’re eyeing a $300,000 home and qualify for a 3% down Conventional loan, you’re looking at needing a bit over $9,000 to make your homeownership dream a reality.

Beyond the down payment, there’s something else to keep in mind – those additional closing costs. They usually fall in the range of $6,000 to $9,000. While some sellers might be open to negotiating and helping out with these costs, in a hot market, that might not be the norm.

Good news, though! I’ve put together a handy guide for anyone looking to buy a home. Whether it’s for you or someone you know, I’m happy to share it. While I can’t set you up with a mortgage, I’m here to chat about the nitty-gritty details. Need to figure out how much you should stash away for your home-buying fund? Let’s talk – I’m here to help you plan it out.